UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

For

the fiscal year ended

OR

FOR THE TRANSITION PERIOD FROM TO

Commission

file number:

(Exact name of Registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices, including zip code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: N/A

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required

to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report.

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No

The

aggregate market value of voting and non-voting common equity held by non-affiliates as of the last business day of the Registrant’s

most recently completed second fiscal quarter (June 30, 2021) was $

Documents Incorporated by Reference

The registrant has incorporated by reference into Part III of this Form 10-K portions of its Proxy Statement for its 2022 Annual Meeting of Shareholders. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2021.

COHBAR, INC.

2021 FORM 10-K ANNUAL REPORT

Table of Contents

i

PART I

Forward-Looking Statements

This report, including the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains forward-looking statements regarding future events and our future results that are based on our current expectations, estimates, forecasts and projections about our business, our results of operations, the industry in which we operate and the beliefs and assumptions of our management. Words such as “may,” “will,” “should,” “could,” “anticipate,” “believe,” “expect,” “intend,” “plan,” “potential,” “continue” and similar expressions are intended to identify these forward-looking statements. Examples of such forward-looking statements include statements regarding:

| ● | our future results of operations and financial position, business strategy, market size and potential growth opportunities; |

| ● | preclinical and clinical development activities; |

| ● | efficacy and safety profiles of our clinical candidates; |

| ● | the anticipated therapeutic properties of our drug development candidates; |

| ● | expectations regarding our ability to effectively protect our intellectual property; and |

| ● | expectations regarding our ability to attract and retain qualified employees and key personnel. |

These statements reflect our current beliefs and are based on information currently available to us. Forward-looking statements involve significant risks and uncertainties, including without limitation, those listed in the “Risk Factors” section. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements including, but not limited to, changes in general economic and market conditions and the risk factors disclosed under “Risk Factors.” Although the forward-looking statements contained in this report are based upon what we believe to be reasonable assumptions, we cannot assure you that actual results will be consistent with these forward-looking statements. Investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date hereof and we assume no obligation to update or revise them to reflect new events or circumstances, except as required by applicable law.

Item 1. Business

OVERVIEW

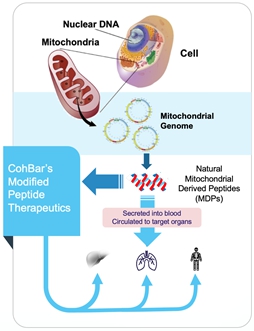

CohBar (“CohBar,” “we,” “us,” “our,” “its” or the “Company”) is a clinical stage biotechnology company leveraging the power of the mitochondria and the peptides encoded in its genome to develop potential breakthrough therapeutics targeting chronic and age-related diseases with limited to no treatment options. Our novel approach is built on the key insights of the Company’s founders that certain mitochondrially encoded peptides produce effects that are not limited to local regulation within the mitochondria and may have important roles to play in critical systemic biological pathways. Many of these effects are quite distinct from traditional mitochondrial function such as energy production and metabolism, involving diverse processes including inflammation, fibrosis and cell signaling.

We believe we have achieved a leading position in exploring the mitochondrial genome and its utility for the development of novel therapeutics, including world-renowned expertise in mitochondrial biology, a broad intellectual property estate with more than 65 patent applications filed, key opinion leaders and disciplined drug discovery and development processes. Our proprietary processes of identifying nucleic acid sequences encoding native peptides in the mitochondrial genome, developing and optimizing novel analogs of these natural mitochondrial derived peptides (“MDPs”), as well as developing and conducting proprietary screens to identify and characterize the activities of these peptides are referred to as our Mito+ platform. We are using our Mito+ platform to identify and develop novel modified versions of natural peptides, which we call analogs, to treat a variety of serious conditions, with a focus on chronic diseases involving inflammation and fibrosis. We believe that the mitochondrial genome may be transformative in the field of drug discovery and that our novel peptide analogs may become a new and major class of drugs with broad therapeutic application. We are currently advancing a pipeline of novel peptide analogs through varying stages of development: CB5138-3 for idiopathic pulmonary fibrosis (“IPF”), CB4211 for the treatment of nonalcoholic steatohepatitis (“NASH”) and obesity, and several preclinical and discovery-stage programs.

1

Potential of Mitochondrial Biology

Our approach leverages the longstanding symbiotic relationship between the mitochondria and the human cell, enabling us to take advantage of millennia of evolutionary pressure. While the central role of mitochondria as the powerhouse of the cell has been well understood for decades, recent research shows a much broader role for this important organelle. Mitochondria have been shown to signal within and between cells, orchestrate multiple biological systems, regulate metabolism and the immune system and control cell cycle, cell growth, and cell death (apoptosis). Other than the nucleus, the mitochondria are the only cell components that have their own genome and we believe the peptides encoded in the mitochondrial genome provide an effective starting point for the development of valuable therapeutics with the potential for better safety and tolerability profiles.

CohBar scientists have mined the mitochondrial genome and discovered multiple unique peptides. After creating novel analogs of these native peptides, we utilize a broad range of proprietary activity screens that are highly predictive of human activity and disease to assess the therapeutic potential of our novel peptides. Our novel analogs are then studied in in vitro and/or in vivo models to confirm their biological effects prior to the selection of a clinical candidate for further testing and ultimate entry into clinical trials. While we look to the mitochondrial genome as the source of our therapeutic peptides, we are not focused on relatively rare diseases caused by specific mitochondrial defects or abnormalities. Rather, our screening is geared towards detecting peptides that interact with cell surface receptors and have activity in important systemic biological pathways, resulting in product candidates with the potential to impact diseases with large unmet medical needs. Building on continued advances in our understanding of mitochondrial contributions to systemic processes, we have discovered a number of peptide families that are structurally unique and have distinct mechanisms of action, providing us with multiple independent opportunities for the successful development of novel therapeutics.

2

We believe that the proprietary capabilities of our Mito+ platform, combined with our scientific expertise and intellectual property portfolio, provide a competitive advantage in our mission to treat chronic and age-related diseases through the advancement of a new class of transformative drugs. Our peptide optimization process is designed to discover numerous potential drug candidate opportunities. These drug candidates may be internally developed by CohBar or advanced through strategic partnerships with larger biopharmaceutical companies. To ensure that we capture the most value from our pipeline, we aggressively file for broad intellectual property coverage, both in the United States and internationally, which we believe is critical to securing CohBar’s leadership role in the field and enabling us to benefit from prior and future discoveries.

We have filed more than 65 patent applications with claims directed to both compositions comprising and methods of using our novel MDPs and their analogs. We are the exclusive licensee from the Regents of the University of California and the Albert Einstein College of Medicine of additional patents that include claims that are directed to compositions comprising natural peptide sequences and their novel analogs and/or methods of their use in the treatment of indicated diseases.

Company Information

We were formed as a limited liability company in the state of Delaware in 2007 and converted to a Delaware corporation in 2009. We completed our initial public offering of common stock in January 2015 and our common stock is listed for trading on The Nasdaq Capital Market (CWBR).

Our corporate headquarters and laboratory are located in Menlo Park, California.

OUR STRATEGY

Our goal is to create a new and powerful class of medicines to address chronic and age-related diseases based on targeting the mitochondrial genome. The key elements of our strategy are to:

| ● | Focus our resources on developing therapies for high-value chronic and/or age-related diseases, with a focus on fibrotic and inflammatory conditions. |

| ● | Advance CB5138-3 through clinical development for IPF while continuing to evaluate additional potential indications. IPF is an area of high unmet medical need where we believe that CB5138-3 can offer differentiated advantages to patients and physicians. Given the broad anti-fibrotic and anti-inflammatory effects we have seen in our preclinical work, we also plan to evaluate other potential indications for this promising product candidate. |

| ● | Selectively form strategic alliances to augment our expertise in exploring the mitochondrial genome and its utility as a source of novel therapeutics to accelerate development and commercialization. We will continue to seek partners who can bring therapeutic expertise, development and commercialization capabilities and funding to allow us to maximize the potential of our pipeline. |

| ● | Leverage our Mito+ technology platform and unique peptide library to develop additional targets and programs. Our team has discovered multiple unique and previously unidentified peptides encoded within the mitochondrial genome that have benefitted from millennia of evolutionary pressure. We are evaluating the potential benefit of novel analogs of these peptides in a variety of models of fibrosis and inflammation, with the objective of maximizing the potential of our pipeline. |

3

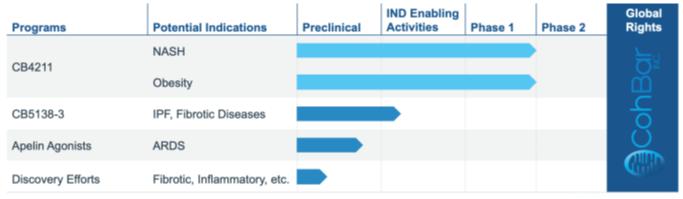

OUR PIPELINE

Our research efforts are focused on utilizing our Mito+ platform to identify, assess and optimize novel analogs of native peptides found in the mitochondrial genome and advancing those candidates with the greatest therapeutic and commercial potential. Our pipeline includes a number of these novel peptide analogs in different stages of research and development.

CB5138-3

In 2021, we nominated our second clinical candidate, CB5138-3, a first-in-class therapeutic under development for the treatment of idiopathic pulmonary fibrosis and other fibrotic diseases. Our CB5138-3 product candidate has impressive preclinical results, with significant anti-fibrotic and anti-inflammatory properties. In addition, we believe CB5138-3 has the potential to provide a better safety and tolerability profile than currently approved IPF drugs, which are poorly tolerated with significant gastrointestinal and/or skin toxicity. When combined with our promising preclinical data, we believe CB5138-3 could provide important clinical and commercial advantages over current standard of care. This program is currently in IND-enabling studies. To date, we have not seen any notable systemic toxicity in rodent or non-human primate studies. Due to additional planned formulation work, we plan to file an Investigational New Drug (“IND”) Application in the second half of 2023 and begin a first-in-human study shortly thereafter.

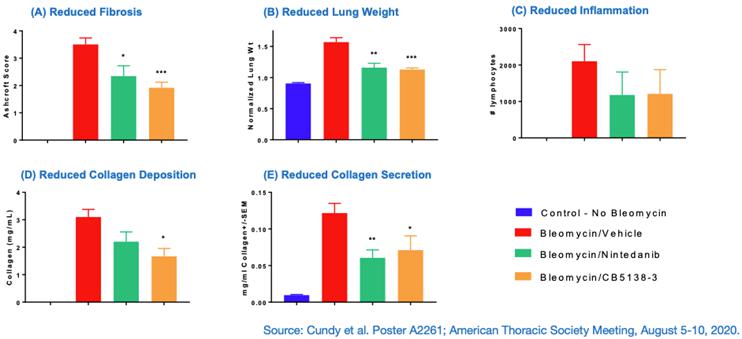

CB5138-3 Preclinical Studies

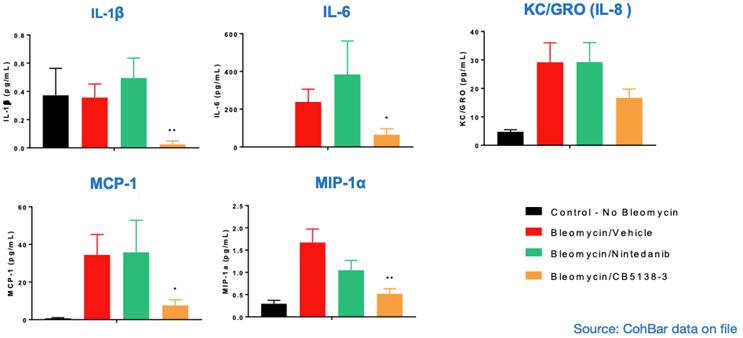

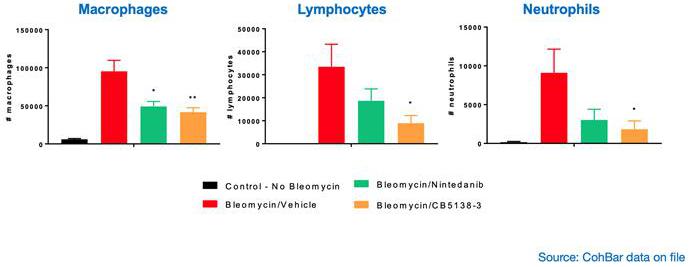

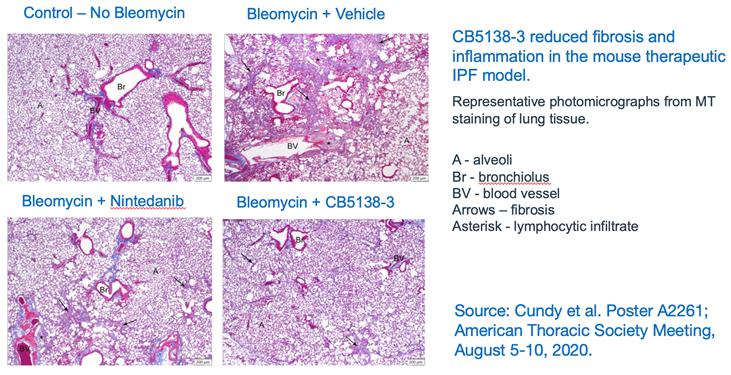

Multiple members of the CB5138 family of peptides have demonstrated anti-fibrotic and anti-inflammatory effects in in vitro and in vivo models. For example, in co-cultures of human lung cells, CB5138-1, a peptide closely related to CB5138-3, decreased the expression of key fibrosis biomarkers, including alpha smooth muscle actin (αSMA), and collagen types I and III. CB5138-1 also decreased the transformation of healthy lung cells into fibrotic cells after induction by TGF-beta1, resulting in reduced production of the fibrotic components αSMA and pro-collagen I alpha 1. Using the therapeutic mouse model of IPF, where peptide treatment is started one week after fibrosis induction with bleomycin, CB5138-3 significantly reduced lung fibrosis assessed by the Ashcroft Score, reduced inflammation, and decreased fibrosis-related changes in lung weight, collagen deposition in lung tissue, and collagen secretion into lung fluid. Data from these studies were presented at the American Thoracic Society (ATS) 2020 Meeting.

4

In the same therapeutic mouse model of IPF, CB5138-3 demonstrated significant favorable anti-inflammatory effects, as evidenced by a reduction in various pro-inflammatory cytokines, chemokines and inflammatory cells in lung fluid (BALF).

5

As seen through the staining of lung tissue, the data from the therapeutic mouse model of IPF demonstrated that CB5138-3 reduced fibrosis and inflammation.

CB4211

Our most advanced clinical candidate, CB4211, is a first-in-class therapeutic under development for the treatment of NASH and obesity. CB4211 recently demonstrated positive effects on reducing biomarkers of liver injury and improving metabolic homeostasis in a Phase 1a/1b clinical study in obese subjects with nonalcoholic fatty liver disease (“NAFLD”). CB4211 is a novel and improved analog of MOTS-c, a naturally occurring MDP. MOTS-c was discovered in 2012 by CohBar founder Dr. Pinchas Cohen and his academic collaborators and has been shown to play a significant role in the regulation of metabolism in animal models. Compared to other assets under development for the treatment of NASH, CB4211 has a unique mechanism of action, which we believe offers a differentiated approach to treating NASH and obesity, as well as the potential to exhibit an enhanced safety profile due to its natural origin. Furthermore, we believe the positive clinical data from our CB4211 trial is an important validation of our overall approach to drug discovery, serving as a proof point that novel analogs of peptides encoded in the mitochondrial genome can impact systemic biological pathways in humans while having an attractive safety and tolerability profile. We have been working to further improve the formulation for CB4211 and intend to partner this program before moving forward into further clinical trials.

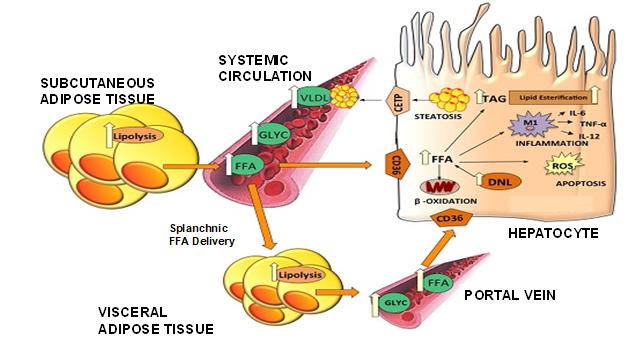

CB4211 Mechanism of Action

We have shown that CB4211 has impacts on regulating fatty acid metabolism, glucose homeostasis, and insulin sensitivity. These studies demonstrated that CB4211 potentiates insulin effects on fatty acid metabolism and glucose homeostasis by extending the duration of insulin receptor (“IR”) activation without altering the magnitude of the response or activation of highly related receptors. For example, CB4211 potentiated insulin-mediated inhibition of lipolysis in isoproterenol-stimulated adipocyte cultures without changing maximal response, while CB4211 alone had no effect. Subsequent de-phosphorylation of IR and downstream targets (IRS-1 and Akt) was markedly slowed in the presence of insulin with CB4211 compared to insulin alone. Inhibitors of IR auto-phosphorylation (GSK183705A) or downstream PI3K/Akt signaling pathway components (wortmannin, Akti-1/2) abolished the antilipolytic effects of insulin alone and in combination with CB4211. Further supporting specificity of insulin signaling, CB4211 enhanced insulin-mediated phosphorylation of IR, IRS-1, and Akt, without affecting IGF mediated phosphorylation of IGF-1R. Consistent with activity through the IR, CB4211 potentiated insulin-induced reduction in glucose production in H4-IIE cells. The acute in vivo effect of CB4211 on insulin tolerance was determined in fasted DIO mice. Administration of CB4211 with insulin enhanced insulin sensitivity, prolonging the reduction in blood glucose levels compared to insulin alone. Data from these studies were presented at the American Diabetes Association (“ADA”) 2018 Meeting.

6

Source: Nutrients 2015,7, 9453–9474

Summary of Results from Phase 1a/1b Clinical Study of CB4211 in Obese Subjects with NAFLD

In August 2021, we released positive topline data from our Phase 1a/1b clinical study of CB4211. The Phase 1a stage of the study was designed to assess the safety, tolerability, and pharmacokinetics of CB4211 following single and multiple-ascending doses in healthy subjects. Subjects in the Phase 1a study experienced mild, but persistent injection site reactions, which were generally seen as painless bumps at the injection site that can be felt under the skin, but in most cases would be otherwise undetectable. We modified the formulation for CB4211 partway through the Phase 1a study and did not observe any persistent injection site bumps with the modified formulation. The subsequent Phase 1b stage was designed to assess the safety, tolerability, and activity of CB4211 in obese subjects with NAFLD. The study met its primary endpoint as CB4211 was well-tolerated and appeared safe with no serious adverse events. The evaluation of the exploratory endpoints in the Phase 1b portion of the trial showed significant reductions from baseline in key biomarkers of liver damage, ALT and AST, and in glucose levels in the CB4211 group compared to placebo after four weeks of treatment, with a trend towards lower body weight. Data from the study were presented at the American Association for the Study of Liver Disease (AASLD) 2021 Liver Meeting®.

Key findings from the topline data of the Phase 1b portion of the study are summarized below.

| Biomarker |

CB4211 (25 mg) (n = 11) |

Placebo (n = 9) |

Difference from Placebo |

MRI-PDFF Data |

CB4211 (25 mg) (n = 11) |

Placebo (n = 9) | |

|

ALT (% reduction from baseline) |

-21% | 4% | -25* |

Baseline Liver Fat Content (LFC) |

21.1% | 15.9% | |

|

Proportion of subjects with >17 U/L decrease in ALT(1) |

27% | 11% | 16% |

Percent Reduction in LFC (Absolute) |

-5.03% |

-4.88% | |

|

AST (% reduction from baseline) |

-28% | -11% | -17%* | Proportion of Responders Achieving >30% Relative Reduction in LFC(2) | 36% | 33% | |

|

Glucose (% reduction from baseline) |

-6% | 0% | -6%* | ||||

ALT: Alanine aminotransferase. AST: Aspartate aminotransferase.

| * | Statistically significant versus placebo, p<0.05 by unpaired t test |

| (1) | A decrease in ALT by 17 U/L or more is significantly associated with histologic response in NASH (Loomba R et al. Gastroenterology, 2019; 156 (1): 88-95) |

MRI-PDFF: Magnetic resonance imaging – proton density fat fraction.

| (2) | A relative reduction of 30% in liver fat is associated with a histological response in non-alcoholic steatohepatitis (Patel J et al. Therap Adv Gastroenterol 2016, 9(5): 692-701) |

7

CB4211 Preclinical Studies

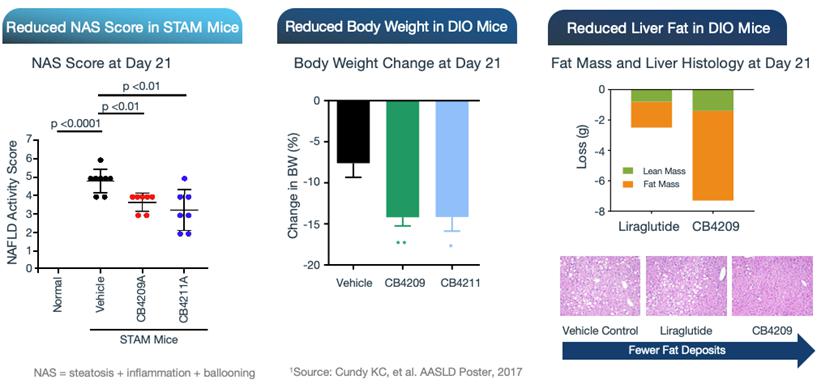

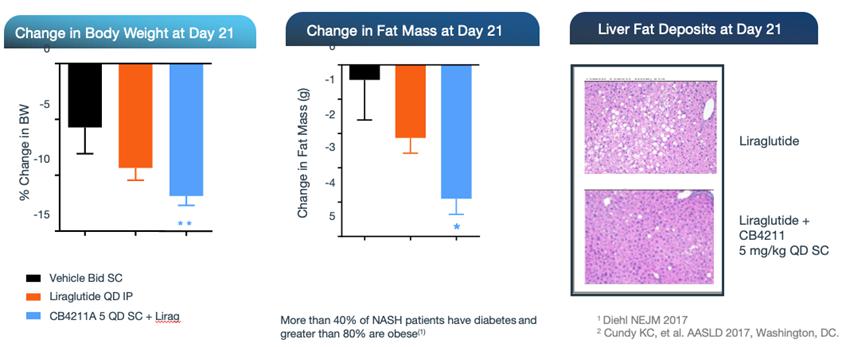

In preclinical studies, CB4211 demonstrated significant therapeutic potential for the treatment of NASH, showing improvements in triglyceride levels, as well as favorable effects on liver enzyme markers associated with NAFLD and NASH. CB4211 also demonstrated significant therapeutic potential for the treatment of obesity, demonstrating significantly greater weight loss together with more selective reduction of fat mass versus lean mass in comparison to the GLP-1 agonist liraglutide, the active ingredient in a market-leading obesity drug, in DIO mice. The therapeutic effects of CB4211 have been further evaluated in the well-established Stelic Animal Model (STAM™) of NASH. In this model, treatment with CB4211 resulted in a significant reduction of the non-alcoholic fatty liver disease activity score, or NAS, a composite measure of steatosis (fat accumulation), inflammation and hepatocyte ballooning (cellular injury). Data from these studies were presented at the AASLD 2017 Liver Meeting®.

In addition, in a mouse model of NASH, CB4211 demonstrated a synergistic effect with liraglutide, with the combination resulting in a significant reduction in body weight and fat mass, as well as a decrease in liver fat, in obese mice.

Discovery Efforts

Our discovery efforts have resulted in the identification of multiple unique and previously unidentified peptides encoded within the mitochondrial genome. Many of these natural sequences and their novel analogs have demonstrated various degrees of biological activity in cell based and/or animal models relevant to a wide range of diseases. Our research efforts have identified and focused on certain of these novel analogs that have demonstrated greatest therapeutic potential. We plan to further explore these peptide families for the potential treatment of a variety of diseases, subject to resource availability and the requirements of our more-advanced programs.

8

CB5064 Analogs

Our discovery efforts have identified CB5064 Analogs, a family of peptides that are agonists of the apelin receptor. By utilizing the protective apelin signaling pathway, our CB5064 Analogs have the potential to address a variety of unmet medical needs such as our initial target of Acute Respiratory Distress Syndrome (“ARDS”). We believe our CB5064 Analogs could be effective in ARDS from a variety of different causes, such as bacterial or viral pneumonia, including COVID-19 associated ARDS. In a preclinical mouse model of ARDS, treatment with CB5064 Analogs reduced fluid accumulation in the lungs and a corresponding broad reduction in levels of key pro-inflammatory cytokines secreted into the lung fluid, when compared to treatment with a placebo control.

CB5064 Analogs Mechanism of Action

Apelin is an endogenous peptide produced and secreted by several cell types, including fat (adipose tissue) and muscle cells, that activates the apelin receptor (“APJ”), a key cell surface receptor. The apelin/APJ axis is involved in protective regulation of fluid homeostasis, cardiovascular function, and metabolism. Activation of APJ, which is broadly expressed but particularly abundant in pulmonary and cardiac tissues, is known to be protective in animal models of ARDS, thrombosis, stroke and sepsis. In addition to its protective effects in lung injury, apelin has also been shown to reduce body weight and improve insulin sensitivity in obese mice. Apelin itself is a poor drug candidate due to its relative instability and short half-life.

Disease Focus

Our research and development focus is predominantly on chronic and age-related diseases and our lead programs are targeted to the following conditions.

Idiopathic Pulmonary Fibrosis – Idiopathic Pulmonary Fibrosis is a chronic, progressive, debilitating, and usually fatal interstitial lung disease that affects approximately 100,000 people in the United States This orphan disease results in fibrosis of the lungs. Idiopathic means “of unknown cause,” though there are certain risk factors that are associated with a higher incidence of IPF, including age (> 50), male gender, smoking, acid reflux and family history of IPF. While many patients do not have symptoms early in the course of the disease, as IPF progresses, symptoms can include persistent dry cough, shortness of breath, especially with exertion, chest pain, loss of appetite and non-intentional weight loss, fatigue and swelling in the legs. Mean survival after diagnosis is only two to three years, which is worse than many cancers. There are two FDA-approved drugs to treat IPF. While both drugs have been shown to decrease the rate of loss of lung function, neither has demonstrated an improvement in survival and both are poorly tolerated by many patients.

NASH – NAFLD is the build-up of extra fat in liver cells that is not due to alcohol consumption. In some patients, NAFLD leads to NASH, a progressive condition involving inflammation and ultimately fibrosis, or scarring, of the liver. This can further progress to cirrhosis (advanced, late-stage scarring). Patients who develop cirrhosis are at risk for complications including liver failure and liver cancer (hepatocellular carcinoma). While the cause of NASH is unknown, it is associated with a broader set of metabolic disorders and important risk factors include elevated triglyceride or cholesterol levels, type 2 diabetes, high blood pressure and obesity, particularly with body fat concentrated around the waist. NASH is also more prevalent in certain ethnic groups including Asian and Hispanic populations. Since there are generally no symptoms until late in the disease progression, many patients have significant liver damage by the time the diagnosis is made. NASH is estimated to impact approximately 12% of the U.S. adult population and there is currently no approved treatment.

Obesity – Obesity impacts more than 40% of U.S. adults and is a major risk factor for a variety of other serious diseases, including heart disease, stroke, type 2 diabetes, NASH and certain types of cancer. Lifestyle interventions have limited success and there is a growing recognition of the need for safe and effective treatments for this important metabolic condition.

Acute Respiratory Distress Syndrome – ARDS occurs when fluid builds up in the tiny, elastic air sacs, or alveoli, of the lungs, resulting in poor blood oxygenation. ARDS is typically a complication of some other primary condition, such as pneumonia, sepsis, or trauma. Current treatment is primarily supportive, along with treatment of the underlying infection or trigger. Mortality rates are high and many patients that survive experience lasting lung damage.

9

COMPETITION

The biopharmaceutical industry is characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary products. While we believe that our scientific knowledge, technology, and research and development experience provide us with competitive advantages, we face potential competition from many different sources, including major biopharmaceutical, specialty pharmaceutical and biotechnology companies, academic institutions and governmental agencies, and public and private research institutions. Many of our competitors may have significantly greater financial resources and capabilities for research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals and marketing approved products than we do. Although our product candidates have unique mechanisms of action compared to most other approved or investigational therapies across the disease areas where we are focusing our development, we will need to compete with currently approved therapies, and potentially those currently in development if they are approved. We are aware of several marketed and investigational products in our leading disease areas, including but not limited to:

| ● | IPF: There are two FDA approved drugs to treat IPF: nintedanib (Ofev), marketed by Boehringer Ingelheim GmbH, and pirfenidone (Esbriet), marketed by Roche Holdings AG. In addition, there are several companies developing product candidates to treat IPF, including AbbVie, Boehringer Ingelheim GmbH, FibroGen, Inc., Galecto, Inc., Pliant Therapeutics, Inc. and Roche Holdings AG. |

| ● | NASH: There are currently no approved therapies for the treatment of NASH. There are several companies developing product candidates to treat NASH, including Madrigal Pharmaceuticals, Inc., Intercept Pharmaceuticals, Inc., Novo Nordisk, Pfizer Inc., Gilead Sciences, Inc., AstraZeneca plc, Eli Lilly & Company, GlaxoSmithKline plc, Amgen, Inc., BMS, Johnson & Johnson, Merck & Co., Inc., Roche Holdings AG, Viking Therapeutics, Inc., Akero Therapeutics, Inc. and Hepion Pharmaceuticals, Inc. |

| ● | Obesity: There are several products currently approved for obesity, such as Saxenda, Contrave, Wegovy, phentermine (Adipex) and other sympathomimetic amines approved for short term use (a few weeks) such as benzphetamine (Didex), diethyoproprion (Tenuate) and phendimetrazine (Bontril), Xenical and Alli, and Qsymia, as well as several investigational therapies that are currently being studied for the treatment of obesity. |

| ● | ARDS: There are no FDA approved drugs to specifically treat ARDS. There are several companies developing product candidates to treat ARDS, including Biohaven Pharmaceutical Holding Company Ltd., Boehringer Ingelheim GmbH, Faron Pharmaceuticals Ltd. Athersys, Inc., and Edesa Biotech. |

EMPLOYEES AND HUMAN CAPITAL RESOURCES

As of March 24, 2022, we had ten employees, nine full-time and one part-time. Additionally, from time to time we engage subject-matter experts on a consulting basis in specific areas of our research and development efforts. None of our employees are represented by a labor union or covered by a collective bargaining agreement. We have not experienced any work stoppages and we consider our relations with our employees to be good.

Our human capital resources objectives include, as applicable, identifying, recruiting, retaining, incentivizing and integrating our existing and additional employees. The principal purposes of our equity incentive plans are to attract, retain and motivate selected employees, consultants and directors through the granting of stock-based compensation awards and cash-based performance bonus awards.

RESEARCH AND DEVELOPMENT

Research and development activities are central to our business model. Our research programs include activities related to discovery of novel MDPs, investigational research to evaluate the potential therapeutic effects of certain discovered natural sequences in research and preclinical studies and engineering novel, improved analogs of certain discovered natural sequences with characteristics suitable for further development as potential drug candidates and advancing our identified candidates through clinical studies. Depending on factors of capability, cost, efficiency and intellectual property rights, we conduct our research programs independently at our laboratory facility. We also outsource some research and development activities pursuant to contractual arrangements with CROs or under collaborative arrangements with academic institutions.

10

INTELLECTUAL PROPERTY

Patents

Our commercial success depends in part on our ability to obtain and maintain proprietary protection for our novel biological discoveries and therapeutic methods, to operate without infringing on the proprietary rights of others and to prevent others from infringing our proprietary rights. We seek to protect our proprietary position by, among other methods, licensing and/or filing patent applications related to our proprietary technology, inventions and improvements that are important to the development and implementation of our business.

Our intellectual property and patent strategy is focused on our MDPs and our novel analogs of these natural peptides. Our strategy is generally to seek patent protection in the United States and, where applicable, in those international jurisdictions we identify as holding significant potential market opportunity for any drug we may develop and in which patent protection is available. We also rely on trade secrets, know-how, continuing technological innovation and potential in-licensing opportunities to develop and maintain our proprietary position. With respect to new biologically active MDPs that we identify within the mitochondrial genome, we typically file provisional patent applications and seek composition-of-matter and method-of-treatment patents for our MDPs, and/or their novel analogs, and prospective novel drug candidates as well as methods of use based on research and preclinical evaluation of therapeutic potential. We intend to file international Patent Cooperation Treaty (“PCT”) applications and/or non-provisional patent applications for those MDPs and/or novel analogs within our pipeline based on further assessment of their therapeutic and commercial potential, as well as strategic and competitive considerations. We believe that the opportunity to engineer analogs or create combination therapies will afford us the opportunity to strengthen IP protection for our drug development candidates as they advance through our development pipeline and to broaden our IP protection internationally.

As of December 31, 2021, we have filed more than 65 patent applications, including at least 10 international PCT applications, with claims directed to both composition of matter and methods of use of novel MDPs and their novel analogs. Our patent applications include filings in the United States, Europe and a number of other foreign countries, with projected expiration dates ranging from 2037 to 2041. Additionally, we are the exclusive worldwide licensee from the Regents of the University of California (the “Regents”) of 15 issued patents that will expire between 2028 and 2034. Other licensed intellectual property is described below.

Terms for individual patents extend for varying periods of time generally depending on the date of filing of the patent application and the legal term of patents in the countries in which they are obtained. Generally, patents issued from applications filed in the United States are effective for twenty years from the earliest non-provisional filing date. In addition, in certain instances, a patent term can be extended to recapture a portion of the term effectively lost as a result of the FDA regulatory review period; however, the restoration period cannot be longer than five years and the total patent term, including the restoration period, must not exceed fourteen years following FDA approval. The duration of foreign patents varies in accordance with provisions of applicable local law, but typically is also twenty years from the earliest international filing date. In certain instances, extension of patent term due to regulatory approval activities is available in foreign countries.

National and international patent laws concerning peptide therapeutics remain highly unsettled. Policies regarding the patent eligibility or breadth of claims allowed in such patents are currently in flux in the United States and other countries. Changes in either the patent laws or in interpretations of patent laws in the United States and other countries can diminish our ability to protect our inventions and enforce our intellectual property rights. Accordingly, we cannot predict the breadth or enforceability of claims that may be granted in our patents or in third-party patents. The biopharmaceutical industry is characterized by extensive litigation regarding patents and other intellectual property rights. Our ability to maintain and solidify our proprietary position for our drugs and technology will depend on our success in obtaining effective claims and enforcing those claims once granted. We do not know whether any of the patent applications that we may file or license from third parties will result in the issuance of any patents. The issued patents that we own, license, or may license or own in the future, may be challenged, invalidated or circumvented, and the rights granted under any issued patents may not provide us with sufficient protection or competitive advantages against competitors with similar technology. Furthermore, our competitors may be able to independently develop and commercialize similar drugs or duplicate our technology, business model or strategy without infringing our patents. Because of the extensive time required for clinical development and regulatory review of a drug we may develop, it is possible that, before any of our drugs can be commercialized, any related patent may expire or remain in force for only a short period following commercialization, thereby reducing any advantage of any such patent.

Summaries of our owned and licensed patent positions are described below.

11

CohBar Owned IP

As of December 31, 2021, we have filed more than 65 patent applications, including applications relating to CB4211, CB5138 Analogs and other CohBar-identified MDPs and novel analogs.

MOTS-c Analog Patent Coverage

We have filed over 20 U.S. and foreign patent applications, including applications in Europe and Asian countries, directed to novel refined analogs of MOTS-c with improved properties, including claims directed to composition of matter and methods of use as well as to formulations containing these peptides. These applications also cover our most advanced product candidate CB4211 and its formulations. If issued, these patents would expire in 2037 or 2039. In 2021, the U.S. Patent and Trademark Office (“USPTO”) granted us a patent that covers CB4211 and related compositions, as well as methods of treatment, including methods of treating NASH. The term of this patent extends to 2037.

CB5138 Analog Patent Coverage

We have filed national and regional patent applications related to a CohBar-identified MDP (CB5138) and novel, improved analogs, including claims directed to composition of matter and methods of use, with a projected expiration date of 2040.

Other CohBar Identified MDPs and Analog Coverage

We have also filed more than 45 provisional patent applications and at least 10 PCT applications related to additional CohBar-identified MDPs and/or their novel, improved analogs, including claims directed to compositions of matter and methods of use. A number of these filings relate to our preclinical programs, including our CB5064 analogs. We intend to file additional non-provisional U.S. patent applications and/or other regional or national patent application for MDPs and/or novel analogs within our pipeline based on further assessments of their therapeutic and commercial potential, as well as strategic and competitive considerations.

CohBar Licensed IP

MOTS-c Patent Coverage

We are the exclusive licensee from the Regents to intellectual property rights related to MOTS-c, including two issued U.S. patents as well as corresponding foreign applications and granted foreign patents filed in multiple countries and regions. These issued patents and applications include composition of matter claims directed to MOTS-c and certain novel analogs of MOTS-c, as well as methods of use claims for MOTS-c or certain novel analogs of MOTS-c as a treatment for type 1 diabetes, T2D, fatty liver, obesity and cancer. Patents related to these filings have been granted in the United States, Europe, Japan and several other countries.

SHLP-2 and SHLP-6 Patent Coverage

We are the exclusive licensee from the Regents to intellectual property for SHLP-2 and SHLP-6 and their novel analogs. This intellectual property includes an issued U.S. patent with a term expiring in 2029.

Humanin and Humanin Analogs Patent Coverage

We are the exclusive licensee from the Regents and the Albert Einstein College of Medicine of Yeshiva University of two U.S. issued patents covering humanin and humanin analogs for treatment of disease which expire in 2028 and 2029.

Trade Secrets

In addition to patents, we rely upon unpatented trade secrets, know-how and continuing technological innovation to develop and maintain our competitive position. We seek to protect our proprietary information, in part, using confidentiality agreements with our commercial partners, collaborators, employees and consultants and invention assignment agreements with our employees. These agreements are designed to protect our proprietary information and, in the case of the invention assignment agreements, to grant us ownership of technologies that are developed through a relationship with a third party. These agreements may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets may otherwise become known or be independently discovered by competitors. To the extent that our commercial partners, collaborators, employees and consultants use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions.

12

Trademarks

We consider COHBARTM to be our common law trademark and are pursuing registration in the United States Patent & Trademark Office. We are also pursuing trademark registration for MITO+ for use in conjunction with research and development of pharmaceutical products.

In-licenses

MOTS-c Exclusive License

On August 6, 2013, we entered into an exclusive license agreement with the Regents to obtain worldwide, exclusive rights under patent filings and other intellectual property rights in inventions developed by Dr. Cohen and academic collaborators at the University of California, Los Angeles. The intellectual property includes the U.S. and foreign patents and patent applications described above under “MOTS-c Patent Coverage.”

We agreed to pay the Regents specified development milestone payments aggregating up to $765,000 for the first product sold under the license. Milestone payments for additional products developed and sold under the license are reduced by 50%. We are also required to pay annual maintenance fees to the licensors. Aggregate maintenance fees for the first three years following execution of the agreement were $7,500. Thereafter, we are required to pay maintenance fees of $5,000 annually until the first sale of a licensed product. In addition, we are required to pay the Regents royalties equal to 2% of our worldwide net sales of drugs, therapies or other products developed from claims covered by the licensed patent, subject to a minimum royalty payment of $75,000 annually, beginning after the first commercial sale of a licensed product. We are required to pay the Regents royalties ranging from 8% of worldwide sublicense sales of covered products (if the sublicense is entered after commencement of Phase II clinical trials) to 12% of worldwide sublicense sales (if the sublicense is entered prior to commencement of Phase I clinical trials). The agreement also requires us to meet certain diligence and development milestones, including filing of an IND Application for a product covered by the agreement on or before the seventh anniversary of the agreement date.

Under the agreement, the license rights granted to us are subject to any rights the U.S. government may have in such licensed rights due to its sponsorship of research that led to the creation of the licensed rights. The agreement also provides that if the Regents become aware of a third-party’s interest in exploiting the licensed technologies in a field that we are not actively pursuing, then we may be obligated either to issue a sublicense for use in the unexploited field to the third-party on substantially similar terms or to actively pursue the unexploited field subject to appropriate diligence milestones. The agreement terminates upon the expiration of the last valid claim of the licensed patent rights. We may terminate the agreement at any time by giving the Regents advance written notice. The agreement may also be terminated by the Regents in the event of our continuing material breach after notice of such breach and the opportunity to cure.

Humanin and SHLPs Exclusive License

On November 30, 2011, we entered into an exclusive license agreement with the Regents and the Albert Einstein College of Medicine at Yeshiva University to obtain worldwide, exclusive rights under patent filings and other intellectual property rights in inventions developed by Drs. Cohen and Barzilai and their academic collaborators. The intellectual property includes the U.S. patents described above under “Humanin and Humanin Analogs Patent Coverage” and “SHLP-2 and SHLP-6 Patent Coverage.”

We agreed to pay the licensors specified development milestone payments aggregating up to $765,000 for the first product sold under the license. Milestone payments for additional products developed and sold under the license are reduced by 50%. We are also required to pay annual maintenance fees to the licensors. Aggregate maintenance fees for the first five years following execution of the agreement were $80,000. Thereafter, we are required to pay maintenance fees of $50,000 annually until the first sale of a licensed product. In addition, we are required to pay the licensors royalties equal to 2% of our worldwide net sales of drugs, therapies or other products developed from claims covered by the licensed patents, subject to a minimum royalty payment of $75,000 annually, beginning after the first commercial sale of a licensed product. We are required to pay royalties ranging from 8% of worldwide sublicense sales of covered products (if the sublicense is entered after commencement of Phase II clinical trials) to 12% of worldwide sublicense sales (if the sublicense is entered prior to commencement of Phase I clinical trials). The agreement also requires us to meet certain diligence and development milestones, including filing of an IND for a product covered by the agreement on or before the seventh anniversary of the agreement date.

Under the agreement, the license rights granted to us are subject to any rights the U.S. government may have in such licensed rights due to its sponsorship of research that led to the creation of the licensed rights. The agreement terminates upon the expiration of the last valid claim of the licensed patent rights. We may terminate the agreement at any time by giving the Regents advance written notice. The agreement may be modified or terminated on a product-by-product basis by the Regents if we materially fail to meet certain diligence requirements and development milestones. The agreement may also be terminated by the Regents in the event of our continuing material breach after notice of such breach and the opportunity to cure. In October 2021, the Regents accepted our payment for an additional year of license maintenance.

13

ENVIRONMENTAL AND OTHER REGULATORY MATTERS

Government Regulation

The preclinical studies and clinical testing, manufacture, labeling, storage, record keeping, advertising, promotion, export, marketing and sales, among other things, of our therapeutic candidates and future products, are subject to extensive regulation by governmental authorities in the United States and other countries. In the United States, pharmaceutical products are regulated by the Food and Drug Administration (the “FDA”) under the Federal Food, Drug, and Cosmetic Act (the “FDCA”) and other laws. Biologics are subject to regulation by the FDA under the FDCA, the Public Health Service Act, and related regulations, and other federal, state and local statutes and regulations. Biological products include, among other things, viruses, therapeutic serums, vaccines and most protein products. Product development and approval within these regulatory frameworks takes a number of years, and involves the expenditure of substantial resources.

Regulatory approval will be required in all major markets in which we, or our licensees, seek to test our products in development. At a minimum, such approval requires evaluation of data relating to quality, safety and efficacy of a product for its proposed use. The specific types of data required and the regulations relating to these data differ depending on the territory, the drug involved, the proposed indication and the stage of development.

In general, new chemical entities are tested in animal models to determine whether the product is reasonably safe for initial human testing. Additional preclinical testing continues during the clinical development stage. Clinical trials for new products are typically conducted in three sequential phases that may overlap. Phase 1 trials typically involve the initial introduction of the pharmaceutical into healthy human volunteers and focus on testing for safety, dosage tolerance, metabolism, distribution, excretion and clinical pharmacology. In the case of serious or life-threatening diseases, such as cancer, initial Phase 1 trials are often conducted in patients directly, with preliminary exploration of potential efficacy. Phase 2 trials involve clinical trials to evaluate the effectiveness of the drug for a particular disease indication or indications in patients with the disease or condition under study and to determine appropriate dosages and dose regimens and the common short-term side effects and risks associated with the drug. Phase 2 trials are typically closely monitored and conducted in a relatively small number of patients, usually involving no more than several hundred subjects. Phase 3 trials are generally expanded, well-controlled clinical trials. They are performed after preliminary evidence suggesting effectiveness, as well as the appropriate dose and dose ranges of the drug, have been obtained, and are intended to gather the additional information about effectiveness and safety that is needed to evaluate the overall benefit-risk relationship of the drug and to provide an adequate basis for product labeling.

In the United States, specific research and preclinical data, chemical data and a proposed clinical study protocol, as described above, must be submitted to the FDA as part of an Investigational New Drug application, or IND, which, unless the FDA objects, will become effective 30 days following receipt by the FDA. Phase 1 trials may commence only after the IND application becomes effective. Following completion of Phase 1 trials, further submissions to regulatory authorities are necessary in relation to Phase 2 and 3 trials to update the existing IND. Authorities may require additional data before allowing the trials to commence and could demand discontinuation of studies at any time if there are significant safety issues. In addition to regulatory review, a clinical trial involving human subjects has to be approved by an independent body. The exact composition and responsibilities of this body differ from country to country. In the United States, for example, each clinical trial is conducted under the auspices of an Institutional Review Board for any institution at which the clinical trial is conducted. This board considers among other factors, the design of the clinical trial, ethical factors, the safety of the human subjects and the possible liability risk for the institution.

14

Information generated in this process is susceptible to varying interpretations that could delay, limit, or prevent regulatory approval at any stage of the approval process. Failure to demonstrate adequately the quality, safety and efficacy of a therapeutic drug under development would delay or prevent regulatory approval of the product.

In order to gain marketing approval, we must submit a new drug application, or NDA, for review by the FDA. The NDA must include a substantial amount of data and other information concerning safety and effectiveness of the drug compound from laboratory, animal and clinical testing, as well as data and information on manufacturing, product stability, and proposed product labeling.

There can be no assurance that if clinical trials are completed that we or any future collaborative partners will submit an NDA or similar applications outside of the United States for required authorizations to manufacture or market potential products, or that any such applications will be reviewed or approved in a timely manner. Approval of an NDA, if granted at all, can take several months to several years, and the approval process can be affected by a number of factors. Additional studies or clinical trials may be requested during the review and may delay marketing approval and involve unbudgeted costs. Regulatory authorities may conduct inspections of relevant facilities and review manufacturing procedures, operating systems and personnel qualifications. In addition to obtaining approval for each product, in many cases each drug manufacturing facility must be approved. Further, inspections may occur over the life of the product. An inspection of the clinical investigation sites by a competent authority may be required as part of the regulatory approval procedure. As a condition of marketing approval, the regulatory agency may require post-marketing surveillance to monitor adverse effects, or other additional studies as deemed appropriate. After approval for the initial disease indication, further clinical studies are usually necessary to gain approval for additional indications. The terms of any approval, including labeling content, may be more restrictive than expected and could affect product marketability.

Holders of an approved NDA are required to report certain adverse reactions and production problems, if any, to the FDA, and to comply with certain requirements concerning advertising and promotional labeling for their products. Moreover, quality control and manufacturing procedures must continue to conform to current good manufacturing practices (“cGMP”) after approval, and the FDA periodically inspects manufacturing facilities to assess cGMP compliance. Accordingly, manufacturers must continue to expend time, money and effort in the area of production and quality control to maintain compliance with cGMP and other aspects of regulatory compliance. We expect to continue to rely upon third-party manufacturers to produce commercial supplies of any products which are approved for marketing. We cannot be sure that those manufacturers will remain in compliance with applicable regulations, or that future FDA inspections will not identify compliance issues at the facilities of our contract manufacturers that may disrupt production or distribution, or require substantial resources to correct.

Any of our future products approved by the FDA will likely be purchased principally by patients through a pharmacy benefit plan or by pharmacies that typically bill various third-party payers, such as governmental programs (e.g., Medicare and Medicaid), private insurance plans and managed care plans, for the pharmaceuticals provided to patients. The ability of customers to obtain appropriate reimbursement for the products they purchase is crucial to the success of new drug and biologic products. The availability of reimbursement affects which products customers purchase and the prices they are willing to pay. Reimbursement varies from country to country and can significantly impact the acceptance of new products. Even if we were to develop a promising new product, we may find limited demand for the product unless reimbursement approval is obtained from private and governmental third-party payers.

15

In the United States and some foreign jurisdictions, there have been a number of legislative and regulatory changes and proposed changes regarding the health care system and efforts to control health care costs, including drug prices, that could significantly affect the development of our business, including preventing, limiting or delaying regulatory approval of our drug candidates and reducing the sales and profits derived from our products once they are approved. For example, in the United States, the Patient Protection and Affordable Care Act of 2010 (“ACA”) substantially changed the way health care is financed by both governmental and private insurers and significantly affects the biopharmaceutical industry. There is continued uncertainty about the implementation of ACA, including the potential for further amendments to the ACA and legal challenges to or efforts to repeal the ACA. We cannot be sure whether additional legislative changes will be enacted, or whether government regulations, guidance or interpretations will be changed, or what the impact of such changes would be on the marketing approvals, sales, pricing, or reimbursement of our drug candidates or products, if any, may be.

If the FDA approves any of our future products and reimbursement for those products is approved by any federal or state healthcare programs, then we will be subject to federal and state laws, such as the Federal False Claims Act, state false claims acts, the illegal remuneration provisions of the Social Security Act, and federal and state anti-kickback laws that govern financial and other arrangements among drug manufacturers and developers and the physicians and other practitioners or facilities that purchase or prescribe products. Among other things, these laws prohibit kickbacks, bribes and rebates, as well as other direct and indirect payments that are intended to induce the use or prescription of medical products or services payable by any federal or state healthcare program, and prohibit presenting a false or misleading claim for payment under a federal or state program. Possible sanctions for violation of any of these restrictions or prohibitions include loss of eligibility to participate in federal and state reimbursement programs and civil and criminal penalties. If we fail to comply, even inadvertently, with any of these requirements, we could be required to alter our operations, enter into corporate integrity, deferred prosecution or similar agreements with state or federal government agencies, and could become subject to significant civil and criminal penalties.

AVAILABLE INFORMATION

Our common stock is listed on The Nasdaq Capital Market and trades under the symbol “CWBR.” Our principal executive offices are located at 1455 Adams Drive, Suite 2050, Menlo Park, California 94025, and our telephone number is (650) 446-7888. The internet address of our corporate website is http://www.cohbar.com.

We file annual reports, quarterly reports, current reports, proxy statements and other information with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended. Our filings with the SEC are available free of charge on the SEC’s website at www.sec.gov and on our website under the “Investors” tab as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC.

The contents of our corporate website are not incorporated into, or otherwise to be regarded as part of, this Annual Report on Form 10-K.

16

Item 1A. Risk Factors

Summary of Risk Factors

An investment in our common stock involves various risks, and prospective investors are urged to carefully consider the matters discussed in the section titled “Risk Factors” prior to making an investment in our common stock. These risks include, but are not limited to, the following:

| ● | we are an early-stage biotechnology company and may never be able to successfully develop marketable products or generate any revenue. We have a limited relevant operating history upon which an evaluation of our performance and prospects can be made. There is no assurance that our future operations will result in profits. If we cannot generate sufficient revenues, we may suspend or cease operations; |

| ● | we have had a history of losses and no revenue; |

| ● | the outbreak of the novel strain of coronavirus, SARS-CoV-2, which causes COVID-19, and the ongoing COVID-19 pandemic, could adversely impact our business, including our clinical trials and preclinical studies; |

| ● | if we fail to demonstrate efficacy or safety in our research and clinical trials, our future business prospects, financial condition and operating results will be materially adversely affected; |

| ● | if any of our future clinical trials are delayed, suspended or terminated, we may be unable to develop our product candidates on a timely basis, which would adversely affect our ability to obtain regulatory approvals, increase our development costs and delay or prevent commercialization of any approved products; |

| ● | if we do not achieve our projected development goals in the time frames we announce and expect, the commercialization of our products may be delayed and, as a result, our stock price may decline; |

| ● | our future success depends on key members of our scientific team and our ability to attract, retain and motivate qualified personnel; |

| ● | we may seek to establish development and commercialization collaborations, and, if we are not able to establish them on commercially reasonable terms, we may have to alter our development and commercialization plans; |

| ● | we may not be successful in our efforts to identify or discover potential drug development candidates; |

| ● | our research and development plans will require substantial additional future funding which could impact our operational and financial condition. Without the required additional funds, we will likely cease operations; |

| ● | even if we are able to develop our potential drugs, we may not be able to obtain regulatory approval, or if approved, we may not be able to generate significant revenues or successfully commercialize our products, which will adversely affect our financial results and financial condition, and we will have to delay or terminate some or all of our research and development plans, which may force us to cease operations; |

| ● | if we do not maintain the support of qualified scientific collaborators, our revenue, growth and profitability will likely be limited, which would have a material adverse effect on our business; |

| ● | we expect to rely on third parties to conduct our clinical trials and some aspects of our research and preclinical testing. These third parties may not perform satisfactorily, including failing to meet deadlines for the completion of such trials, research or preclinical testing; |

| ● | we contract with third parties for the manufacture of our peptide materials for research and preclinical testing and expect to continue to do so for any future product candidate advanced to clinical trials and commercialization. This reliance on third parties increases the risk that we will not have sufficient quantities of our research peptide materials, product candidates or medicines, or that such supply will not be available to us at an acceptable cost, which could delay, prevent or impair our research, development or commercialization efforts; |

17

| ● | we may not be able to develop drug candidates, market or generate sales of our products to the extent anticipated. Our business may fail, and investors could lose all of their investment in our Company; |

| ● | interim and preliminary or topline data from our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data; |

| ● | we expect to expand our drug development and regulatory capabilities, and as a result, we may encounter difficulties in managing our growth, which could disrupt our operations; and |

| ● | the use of any of our products in clinical trials may expose us to liability claims, which may cost us significant amounts of money to defend against or pay out, causing our business to suffer. |

CohBar operates in an environment that involves a number of risks and uncertainties. The risks and uncertainties described in this Annual Report on Form 10-K are not the only risks and uncertainties that we face. Additional risks and uncertainties that presently are not considered material or are not known to us, and therefore are not mentioned herein, may impair our business operations. If any of the risks described in this Annual Report on Form 10-K actually occur, our business, operating results and financial position could be adversely affected.

Risks Related to Our Financial Position and Need for Additional Capital

We have had a history of losses and no revenue.

We have generated substantial accumulated losses since our inception. We have not generated any revenues from our operations to date and do not expect to generate any revenue in the near future. As a result, our management expects the business to continue to experience negative cash flow for the foreseeable future. We can offer no assurance that we will ever operate profitably or that we will generate positive cash flow in the future.

Until we can generate significant revenues, if ever, we expect to satisfy our future cash needs through equity or debt financing. We will need to raise additional funds, and such funds may not be available on commercially acceptable terms, if at all. If we are unable to raise funds on acceptable terms, we may not be able to execute our business plan, take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements. This may seriously harm our business, financial condition and results of operations. In the event we are not able to continue operations, investors will likely suffer a complete loss of their investments in our securities.

We are an early-stage biotechnology company and may never be able to successfully develop marketable products or generate any revenue. We have a limited relevant operating history upon which an evaluation of our performance and prospects can be made. There is no assurance that our future operations will result in profits. If we cannot generate sufficient revenues, we may suspend or cease operations.

We are an early-stage company. Our operations to date have been limited to organizing and staffing our Company, business planning, raising capital, identifying MDPs for further research, developing our intellectual property portfolio, performing research on identified MDPs and our novel analogs and progressing our most advanced drug candidate into and through clinical studies. We have not generated any revenues to date. All of our novel peptide analogs are in the concept, research or early clinical stages. Moreover, we cannot be certain that our research and development efforts will be successful or, if successful, that our novel peptide analogs will ever be approved by the FDA. Typically, it takes 10 to 12 years to develop one new medicine from the time it is discovered to when it is available for treating patients, and longer timeframes are not uncommon. Even if approved, our products may not generate commercial revenues. We have no relevant operating history upon which an evaluation of our performance and prospects can be made. We are subject to all of the business risks associated with a new enterprise, including, but not limited to, risks of unforeseen capital requirements, failure of potential drug candidates either in research, preclinical testing or in clinical trials, and failure to establish business relationships and competitive advantages against other companies. If we fail to become profitable, we may be forced to suspend or cease operations.

18

The outbreak of the novel strain of coronavirus, SARS-CoV-2, which causes COVID-19, and the ongoing COVID-19 pandemic, could adversely impact our business, including our clinical trials and preclinical studies.

Public health crises such as pandemics or similar outbreaks could adversely impact our business. In response to the global COVID-19 pandemic, we have modified our business practices by restricting nonessential travel, implementing a partial work from home policy for our employees and instituting new safety protocols for our lab to enable essential on-site work to continue. We continue to monitor the impact of COVID-19 on ongoing activities at our external research and development partner sites.

Timely enrollment in our clinical trials is dependent upon global clinical trial sites, which may be adversely affected by global health matters, such as pandemics. These and any additional delays in our clinical trials could increase our development costs, delay or prevent the availability of topline data expected to be available from the trial, delay our product development and regulatory submission process, result in the termination of the trial or make it difficult to raise additional capital.

As a result of the COVID-19 outbreak, or similar pandemics, we may experience disruptions that could severely impact our business, clinical trials and preclinical studies, including:

| ● | delays or difficulties in recruiting, enrolling and retaining patients in our clinical trials; |

| ● | delays or difficulties in clinical site initiation, including difficulties in recruiting clinical site investigators and clinical site staff; |

| ● | delays or disruptions in non-clinical experiments and investigational new drug application-enabling good laboratory practice standard toxicology studies due to unforeseen circumstances in the supply chain; |

| ● | increased rates of patients withdrawing from our clinical trials following enrollment as a result of contracting COVID-19, being forced to quarantine or not accepting home health visits; |

| ● | diversion of healthcare resources away from the conduct of clinical trials, including the diversion of hospitals serving as our clinical trial sites and hospital staff supporting the conduct of our clinical trials; |

| ● | interruption of key clinical trial activities, such as clinical trial site data monitoring, due to limitations on travel imposed or recommended by federal or state governments, employers and others or interruption of clinical trial subject visits and study procedures (particularly any procedures that may be deemed non-essential), which may impact the integrity of subject data and clinical study endpoints; |

| ● | interruption or delays in the operations of the FDA and comparable foreign regulatory agencies, which may impact approval timelines; |

| ● | limitations on employee resources that would otherwise be focused on the conduct of our preclinical studies and clinical trials, including because of sickness of employees or their families, the desire of employees to avoid contact with large groups of people, an increased reliance on working from home or mass transit disruptions; |

| ● | disruptions in the supply chain and the manufacture or shipment of both drug substance and finished drug product for our product candidates for preclinical testing and clinical trials; |

| ● | interruption of, or delays in receiving, supplies of our product candidates from our contract manufacturing organizations due to staffing shortages, production slowdowns or stoppages and disruptions in delivery systems; and |

| ● | reduced ability to engage with the medical, investor and partnering communities due to the cancellation of conferences scheduled throughout the year. |

19

In addition, the trading prices for our common stock and other biopharmaceutical companies have been highly volatile as a result of the COVID-19 pandemic and the resulting impact on economic activity. As COVID-19 transitions from a pandemic to an endemic disease, we are uncertain about its ongoing effect on both domestic and worldwide economic activity, which may continue to be unpredictable. As a result, we may face difficulties raising capital through sales of our common stock or other equity-linked securities, and any such sales may be on unfavorable terms to us and potentially dilutive to existing stockholders.

The extent to which the pandemic may impact our business, clinical trials and preclinical studies will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the duration of the pandemic, the emergence of novel variants of SARS-CoV-2, the impact of vaccinations and vaccination rates, travel restrictions and actions to contain the virus or treat its impact, such as social distancing and quarantines or lock-downs in the United States and other countries, business closures or business disruptions and the effectiveness of actions taken in the United States and other countries to contain and treat the disease. For example, primarily due to COVID-19 related restrictions and disruption, we have experienced delays in shipping raw materials to our partners in China, which has delayed certain of our investigational new drug application-enabling activities.

If we fail to demonstrate efficacy or safety in our research and clinical trials, our future business prospects, financial condition and operating results will be materially adversely affected.

The success of our research and development efforts will greatly depend on our ability to demonstrate efficacy of our novel peptide analogs in non-clinical studies, as well as in clinical trials. Non-clinical studies involve testing potential drug candidates in appropriate non-human disease models to demonstrate efficacy and safety. Regulatory agencies evaluate these data carefully before they will approve clinical testing in humans. If certain non-clinical data reveals potential safety issues or the results are inconsistent with an expectation of the potential drug’s efficacy in humans, the program may be discontinued or the regulatory agencies may require additional testing before allowing human clinical trials. This additional testing will increase program expenses and extend timelines. We may decide to suspend further testing on our potential drugs if, in the judgment of our management and advisors, the non-clinical test results do not support further development.

Moreover, success in research, preclinical testing and early clinical trials does not ensure that later clinical trials will be successful, and we cannot be sure that the results of later clinical trials will replicate the results of prior clinical trials and non-clinical testing. The clinical trial process may fail to demonstrate that our potential drug candidates are safe for humans and effective for indicated uses. This failure would cause us to abandon a drug candidate and may delay development of other potential drug candidates. Any delay in, or termination of, our non-clinical testing or clinical trials will delay the filing of an investigational new drug application and new drug application with the FDA or the equivalent applications with pharmaceutical regulatory authorities outside the United States and, ultimately, our ability to commercialize our potential drugs and generate product revenues. In addition, our Phase 1a/1b trial of CB4211, our most advanced drug candidate, involved, and we expect that our other early clinical trials will involve, small patient populations. Because of these small sample sizes, the results of these early clinical trials, including the topline data from our CB4211 Phase 1a/1b trial, may not be indicative of future results.

Risks Related to Discovery, Development and Commercialization

If any of our future clinical trials are delayed, suspended or terminated, we may be unable to develop our product candidates on a timely basis, which would adversely affect our ability to obtain regulatory approvals, increase our development costs and delay or prevent commercialization of any approved products.